Brazil to Implement Mandatory Sustainability Reporting Following ISSB Standards

Brazil's Securities and Exchange Commission (CVM) and Ministry of Finance recently declared that public companies in Brazil will be mandated to report on sustainability and climate-related disclosures starting in 2026. The CVM stated that the new reporting requirements will align with the latest standards released by the International Sustainability Standards Board (ISSB) and will follow a phased approach, commencing with voluntary reporting in 2024.

The ISSB, initiated at COP26 by the International Financial Reporting Standards (IFRS) Foundation Trustees, aims to meet the increasing demand for comprehensive sustainability standards that are tailored to investors and financial markets. With support from key global entities and finance ministers from over 40 jurisdictions, the ISSB builds on established reporting initiatives like the Task Force on Climate-Related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB) to provide market-informed standards that foster international comparability and avoid double-reporting.

Source: ESG Professionals Network

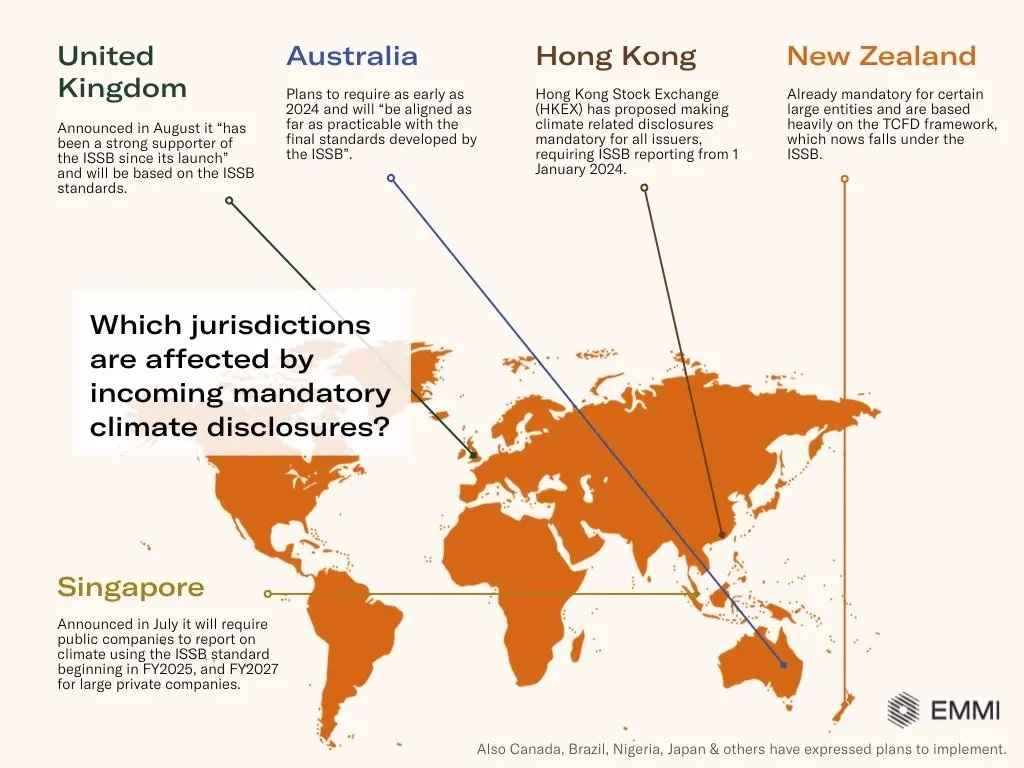

Brazil’s adoption of ISSB standards positions it among other jurisdictions, such as the UK and Australia, that have recently made similar commitments. It also aligns with Brazil's broader Ecological Transformation Plan, introduced earlier this year, designed to steer the nation towards a green economy through substantial public and private investments in sustainable agriculture, renewable energy, sustainable infrastructure and other climate strategies amounting to $350 billion.

Source: EMMI

Kai Keller, head of Regional Strategy and Partnerships for the World Economic Forum, noted that “Brazil and other developing economies face different climate challenges compared to the rest of the globe. For example, Brazil’s agricultural sector plays a relatively outsized role in its climate footprint compared to developed economies. Meanwhile, its energy and transport sectors contribute much less. Policymakers, business leaders and industry experts need to come together to help Brazil attract the investment needed to successfully reach their climate targets.”

Source: McKinsey & Company

The disclosure requirements under the new resolution will not only reinforce Brazilian capital markets by enhancing transparency but will also help local companies attract these global investments. The CVM’s announcement coincided with a meeting between the ISSB and the Association of Supervisors of Bank of the Americas (ASBA) during which they discussed the advantages of improved sustainability disclosures for the banking sector to better address climate risks and opportunities in the Americas. Latin American countries have shown a proactive approach to mandating sustainability-related financial disclosures with Chile, Colombia, and Mexico actively considering or already implementing standards similar to those proposed by the ISSB.

The adoption of the ISSB standards in Brazil is a significant step towards a more transparent and sustainable global financial landscape, encouraging other nations to follow suit in ensuring reliable and comparable data on emerging risks and opportunities. Following Brazil’s announcement, ISSB Chair Emmanuel Faber stated: “We continue to hear strong support for the ISSB's Standards from regulators globally and I commend the Brazilian Ministry of Finance and Comissão de Valores Mobiliários for providing clarity to companies and investors in Brazil by setting out a clear roadmap towards mandatory adoption.”