ESG Considerations in M&A: Navigating the Changing Landscape

Overview:

In the ever-evolving landscape of Mergers & Acquisitions (M&A), environmental, social, and governance (ESG) factors are gaining prominence. Deloitte’s 2024 M&A Trends Survey reveals that successful dealmakers embrace uncertainty, prioritize value creation, and bridge gaps between private equity and corporate approaches. By understanding and leveraging ESG considerations, companies can navigate the changing M&A landscape effectively.

Summary:

Source: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-2024-ma-esg-survey.pdf

In today’s dynamic business environment, environmental, social, and governance (ESG) factors are no longer peripheral—they’re at the heart of strategic decision making. As companies engage in Mergers & Acquisitions (M&A), understanding the role of ESG becomes crucial. Deloitte’s 2024 M&A Trends Survey, sheds light on how dealmakers are adapting, innovating, and creating value in an ever evolving landscape.

Growing ESG Influence:

ESG considerations are gaining prominence in the business world due to concerns about climate change, sustainability, diversity, and inclusion.

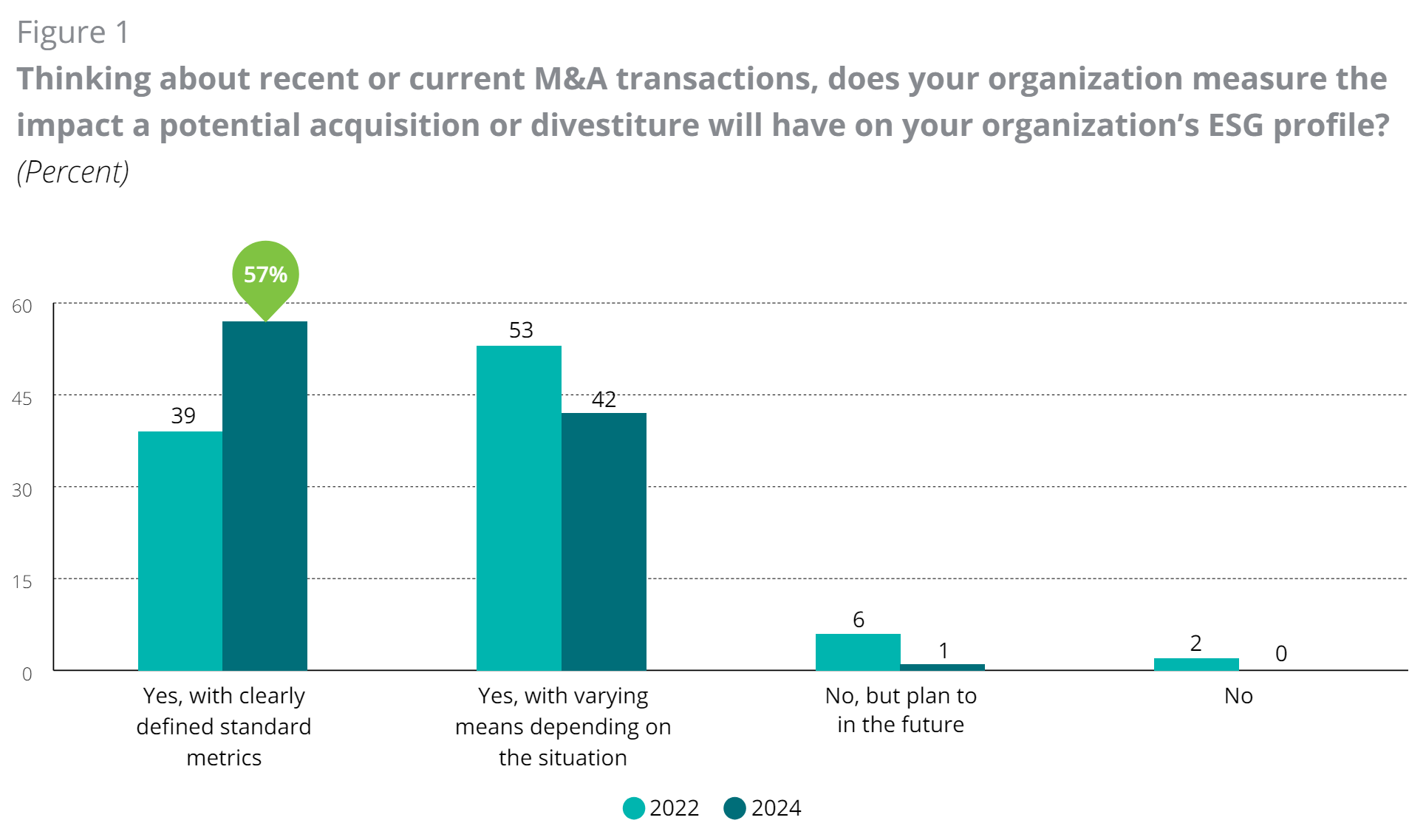

Companies are re-evaluating their investments and activities through an ESG lens, including during M&A transactions.

2024 M&A Trends Survey Methodology:

Deloitte conducted a comprehensive survey of 1,500 corporate and private equity dealmakers in 2024.

Two-thirds of respondents were senior decision-makers at the C-suite or senior managing director level.

Private equity investors represented almost half (49%) of the sample.

The survey revealed that dealmakers are adapting to a changing M&A landscape, driven by market uncertainty and innovation.

Pivots and Innovation:

Despite challenges, dealmakers are shifting course and persevering in their pursuit of value.

The survey suggests that M&A activity may rebound in the coming year.

Companies are finding new ways to realize cooperative synergies, premiums, and returns.

Private Equity vs. Corporations:

Corporations focus on cooperative synergy realization over the medium and longer terms.

Private equity firms prioritize shorter-term returns on investments.

Bridging the gap between these approaches can unlock real value creation opportunities.

Embracing Uncertainty:

Successful dealmakers center their M&A planning, strategy, and execution around embracing uncertainty.

Rather than avoiding complexity, they analyze and exploit the M&A landscape.

Decision-makers are building bridges and extending their view with an ESG lens to achieve success.

In summary, ESG considerations are reshaping M&A decisions, and dealmakers are adapting to market changes. By embracing uncertainty and bridging gaps, companies can create value.